Despite the overall market growth in the first half of 2025, global electric vehicle sales reached 9.1 million units, which is 28% higher than in the same period of 2024.

Despite overall growth, Tesla's ongoing difficulties are particularly noticeable. The company again reported a decline in global deliveries. This correlates with a weakening position in key markets, especially China, and decreasing investor interest. The latter is reflected in downward pressure on Dow Jones futures.

The Chinese electric vehicle market has maintained its dominant position, reaching sales of 5.5 million units in the first six months of the year. This represents a significant increase of 32% year-on-year. Moreover, China accounted for over 60% of all electric vehicles sold worldwide during this period.

The market has reached a high degree of maturity: electric vehicles account for about half of all new passenger cars. Intense internal competition and market saturation force Chinese manufacturers to actively seek export opportunities.

The European Union remained the second-largest electric vehicle market in the world with sales of 2 million units, up 26% from a year earlier. A key growth driver was the introduction of new, more affordable models that attracted a broader range of buyers.

Notably, the rechargeable hybrid segment showed robust growth, and sales increased by 27%. This growth is partly due to the activity of Chinese automakers who export them to Europe. EU Import duties are significantly lower than those on full electric vehicles. The following companies maintained their leadership in the European market in the first half of the year:

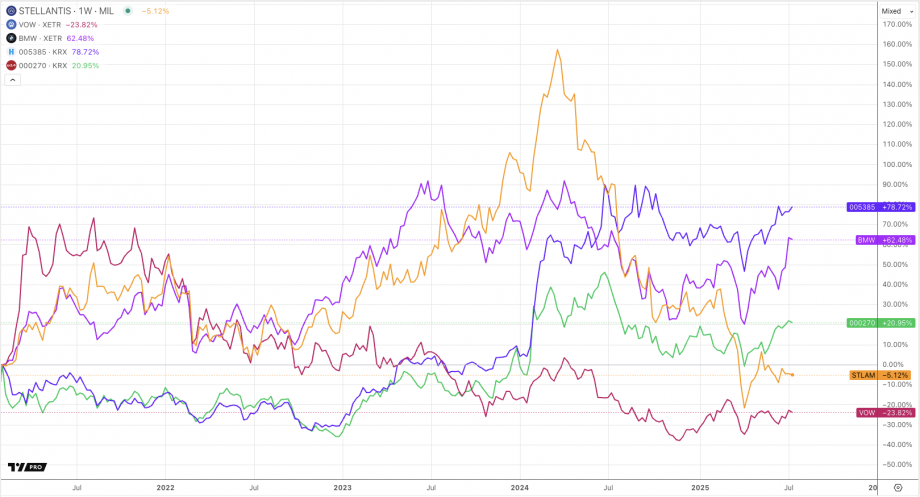

- Volkswagen Group

- Stellantis

- BMW Group

- Hyundai

- Kia

The North American market showed a modest 3% increase in electric vehicle sales, reaching 900,000 units. The dynamics within the region were mixed: sales in the United States increased by 6%, Mexico showed solid growth of 20%, while Canada experienced a significant 23% decline due to subsidy program changes and infrastructure challenges.

The Donald Trump administration's plans to cut federal electric vehicle purchase subsidies pose a significant risk to the US market, which are due to take effect on September 30, 2025. It is expected that this may cause a short-term surge in demand in the third quarter, as buyers rush to secure subsidies before the deadline. About half of electric vehicle buyers in the United States currently meet subsidy criteria, partly because of limitations on car prices, buyer income, and component sourcing.

The global electric vehicle market is showing steady growth, but its driving forces and dynamics vary significantly by region. China retains absolute leadership in terms of volume and growth rates, Europe is showing steady development due to supply diversification, while North America, especially the United States, is facing subsidy policy challenges.

Increased protectionism (duties in the EU and the USA) and Chinese manufacturers' retaliatory export strategies are becoming key factors shaping the future configuration of the global electric vehicle market.