Kioxia, the world's third-largest flash memory manufacturer, has filed for an initial public offering (IPO). The company's valuation is only $4.85 billion, a significant decrease compared to its historical value. In 2018, Toshiba Memory Corporation's assets were bought out by a consortium of investors led by Bain for $12.9 billion.

Previously, Kioxia actively invested in research and development, which allowed it to take a stable position in the market. The company focused on 3D NAND technologies, which made it possible to produce more efficient and productive chips. Overall, the demand for flash memory and storage continued to grow, increasing the company's profits. The need for high-performance memory has increased with the development of the tech sector, cloud storage, IT infrastructure, and data volumes.

According to the latest data, Kioxia will gain only about $646 million from its launch on the Tokyo Stock Exchange, scheduled for December 18. The listing will take place at the bid price of 1,390 yen per share. This situation is most likely caused by a drop in the company's market value, which creates certain risks for current shareholders such as Bain and Toshiba, who can partially get rid of their shares.

An open placement of shares will enable the market to assess the company's value based on supply and demand. It can also increase transparency in the company's financial performance and business practices. A successful listing can enhance Kioxia's reputation in the industry, creating a higher level of trust among customers and partners.

For Toshiba, which was once significantly involved in producing solid-state memory, the problem is compounded by the fact that it still owns more than 40% of Kioxia shares, making it very difficult for its further investments. The IPO strategy will also allow Kioxia to issue new shares worth about $179 million, an important step to increase the company's liquidity.

Kioxia's wait-and-see policy regarding IPOs is not new — the first attempt was made in 2020 but was blocked due to unfavorable market conditions. Given the decrease in the company's capitalization, the current conditions of the IPO are also challenging to call profitable for existing shareholders.

As one of the industry's key players, the Kioxia listing could impact the semiconductor market as a whole, especially given current global trends in manufacturing and demand for memory and data storage. This has happened before, when NVIDIA entered the market and sparked a boom in the graphics accelerator segment. Now, Nvidia stock ranks third among the S&P 500's biggest gainers for 2024, accounted for 20% of the index's total returns.

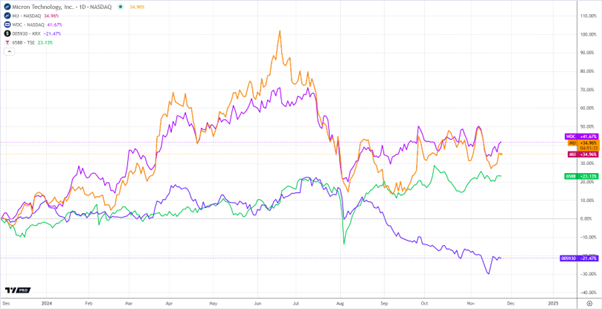

It is worth noting that Kioxia is not the only flash memory manufacturer traded on the stock exchange. Other well-known players in the market include Micron Technology, Western Digital, and Samsung Electronics. Their successful listings and shareholder capitalization can indicate Kioxia's entry into the stock market.

Kioxia's IPO represents a significant step for the company and its shareholders. Despite certain risks and unfavorable conditions for the current owners, this opening of new share capital can begin a new page in Kioxia's history and provide financial resources for business development. Listing on the stock exchange can help the company invest in further developments and increase its competitiveness.