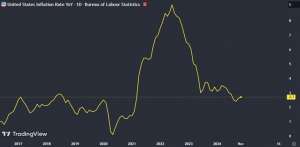

In January 2025, Social Security beneficiaries experienced a 2.5% cost-of-living adjustment (COLA), marking the smallest increase in four years. This adjustment, effective from January 2025, translates to an average monthly benefit increase of approximately $50, bringing the average monthly check to $1,976. Optima Tax Relief reviews how this increase could mean more taxes for retired individuals.

Impact on Taxes and Medicare Premiums

While the COLA aims to help retirees keep pace with inflation, it also has implications for taxes and Medicare premiums.

Tax Implications

The increased Social Security benefits are considered taxable income. For many retirees, this additional income could push them into a higher tax bracket, leading to a higher tax liability. It's essential for beneficiaries to assess how the COLA affects their overall taxable income and plan accordingly.

Medicare Premiums

Medicare Part B premiums, which cover outpatient services, are deducted from Social Security benefits. In 2025, these premiums are expected to rise, potentially consuming a significant portion of the COLA increase. This means that the net benefit to retirees may be less than anticipated, as higher premiums offset the COLA.

Additional Considerations

Beyond taxes and Medicare premiums, retirees should be aware of other factors influenced by the COLA.

Tax Bracket Adjustments

The additional income from the COLA could affect eligibility for certain tax credits or deductions, such as the Child Tax Credit or the Premium Tax Credit for health insurance purchased through the marketplace. In some cases, this increase in taxable income could push individuals into a higher tax bracket, resulting in a larger overall tax bill.

State Taxes

In addition to federal taxes, retirees should consider the impact of state taxes on their Social Security benefits. Some states tax Social Security benefits, while others do not. Understanding your state's tax treatment of Social Security benefits is crucial to avoid unexpected state tax liabilities.

Example Scenario

In 2025, Jane, a retired individual, receives a 2.5% COLA increase in her Social Security benefits, raising her monthly check by $50, bringing it to $1,950. However, the increase in benefits also comes with tax and Medicare implications. Jane’s total income, including pensions and IRA withdrawals, could now push her into a higher tax bracket, increasing her overall tax liability. In addition, Medicare Part B premiums rise by $10 per month, reducing her net benefit. Instead of the full $50 increase, Jane effectively gains only $40 a month, or $480 for the year, due to the higher premiums. If her state taxes Social Security benefits, she could owe an additional $30 in state taxes, further reducing her net increase.

This example illustrates how Social Security COLA increases can result in higher taxes and premiums, leaving retirees with a smaller net benefit than expected. It’s important for retirees to plan accordingly and adjust their financial strategies to account for these changes.

Planning Ahead

Given these considerations, it's advisable for retirees to plan ahead. Here are some tips to keep in mind.

1. Review Tax Withholding: Assess whether the increased Social Security benefits necessitate adjustments to tax withholding to avoid underpayment penalties.

2. Consult Financial Advisors: Engage with financial professionals to develop strategies that mitigate the impact of higher taxes and premiums, such as tax-efficient withdrawal strategies or exploring other income sources.

3. Stay Informed: Regularly monitor updates from the Social Security Administration and Medicare to stay informed about changes that could affect your benefits and financial planning.

Conclusion

In summary, while the 2.5% COLA increase provides some relief to retirees, it also introduces new financial considerations. Understanding the interplay between increased benefits, taxes, and Medicare premiums is essential for effective retirement planning.