Wealth contains a powerful potential for prosperity for many generations of an affluent family. By investing money in profitable and socially useful projects, wealthy families strengthen their reputation in society and ensure the well-being of their descendants. However, inept capital management leads to its squandering and ultimately significantly restricts the financial and life opportunities for all family members.

Wise wealth management is a complex science learned not only from books but also through extensive practical experience. The wealth management consulting industry allows high-net-worth families to receive valuable advice on many aspects of their lives related to maintaining and increasing wealth. However, not every company in this industry can provide effective assistance. Find out about those ones that can help preserve the wealth of their clients and open up new prospects for them. Their brilliant reputation and support of former and current clients are the best guarantee of their professionalism and high moral principles.

About the Importance of Wealth Management Consulting Companies

Today, opportunities for investing capital are becoming more diverse. In addition to traditional methods of investing in shares of successful companies, bonds, and cash, alternative investments are becoming more widespread. These include investments in works of art, cryptocurrencies, derivative contracts, innovations, etc. As the CFA Institute notes, alternative investments are attractive to investors due to their higher returns. At the same time, they differ in more complicated tax and legal considerations.

Moreover, in an unstable world, the challenges for capital placement are increasing. A sudden collapse of entire sectors of the economy or threats to assets located in other countries can lead to serious losses. Also, we should remember the rapid development of technologies revolutionizing our reality, while simultaneously making obsolete many methods of production or doing business in which you may have invested money.

To conduct an objective assessment of the proposed investment projects and identify and neutralize potential threats, you need expert knowledge. Moreover, the scope of this expertise goes far beyond just financial or economic disciplines. To invest large sums of money in any projects, especially international ones, you will need knowledge in the fields of law, politics, geopolitics, and even cultural studies. Wealth management consulting companies assemble highly professional teams that include specialists in various fields. That is why their assessment and advice on wealth management are objective and effective.

Top Wealth Management Companies That Follow All Modern Trends

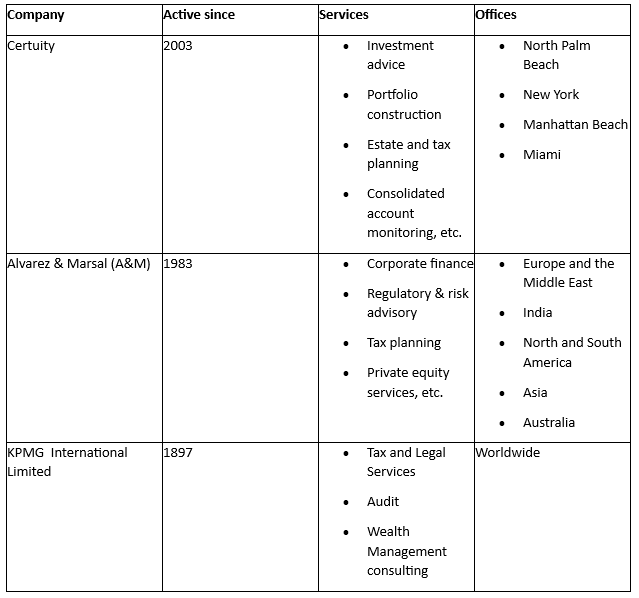

Doing business in the old-fashioned way or managing wealth the way previous generations did is no longer enough. Modern wealth management consulting is looking for new approaches that meet the challenges and demands of the times. For example, Certuity Company offers its clients a dynamic wealth management strategy with robust performance indicators.

Below, you will find consulting companies that successfully combine the advantages of traditional and innovative approaches to wealth management.

Certuity Company

If you are unsure how to wisely manage your wealth in the fast-changing market environment, take advantage of the Certuity Company professional experience. The firm is a Registered Investment Advisor (RIA), which offers comprehensive services related to wealth management. In addition, it is a nationally recognized multi family office, providing services to ultra-high-net-worth families. Certuity Company advises individual and institutional clients:

- Affluent individuals

- Entrepreneurs and businessmen

- Professional investors

- Wealthy families

- Family offices

The company offers its clients a holistic approach based on fundamental market research and careful risk management. You can turn to Certuity for professional advice and implementing competent wealth management strategies.

Alvarez & Marsal (A&M)

Alvarez & Marsal is a consulting company that operates on 6 continents, promoting wealth growth and conscious capital management. It helps a broad spectrum of clients — from thriving businesses wishing to reach a new level of development to distressed borrowers who do not know how to get out of the debt hole. Here are just some of the types of clients who can benefit from the company's services:

- Corporations

- Private investors

- Government agencies

- Non-profit organizations

- Fiduciaries, etc.

If you need professional advice multiplied by the experience of wealth management consulting in 39 countries, contact one of the 83 Alvarez & Marsal offices located around the world.

KPMG International Limited

KPMG is a global network of companies providing services in various areas related to wealth management:

- Audit and assurance

- Business protection

- Digital transformation

- Adaptation to regulatory changes

- Tax planning, etc.

This consulting company has the largest client coverage since it provides its services in 143 countries around the world. Therefore, you can easily find its offices near you.

The Bottom Line

When deciding on a wealth management company, evaluate its past success and vision of the future. Its experience influences the solutions it will offer you for more effective wealth management. And its vision of the future will show you how much your idea of the desired state of the world matches its outlook. If they coincide, it is your ideal wealth management partner!