In times of financial need, exploring various avenues to secure a loan becomes paramount. One such avenue that often goes underutilized is leveraging property assets to obtain loans. Loan against property (LAP) is a secured loan option where you pledge your property as collateral to secure funds from a financial institution. It's a versatile financial tool that can be utilized for various purposes such as business expansion, education expenses, medical emergencies, or even debt consolidation. What makes LAP particularly attractive is the potential for lower interest rates compared to other loan options. Let's delve deeper into how you can unlock capital by discovering the lowest interest rates for loans against property.

Understanding Loan Against Property

Before diving into interest rates, it's essential to understand the concept of loan against property and how it works. In simple terms, it's a loan where you pledge your property (residential or commercial) as collateral in exchange for funds from a lender. The loan amount typically depends on the value of the property and can range from a few lakhs to crores of rupees. Lenders assess the property's value and offer a loan amount based on a certain percentage of the property's market value, often referred to as the Loan to Value (LTV) ratio.

Why Choose Loan Against Property?

-

Lower interest rates compared to personal loans: LAP offers relatively lower interest rates compared to unsecured loans like personal loans, making it a cost-effective borrowing option.

-

Higher loan amounts: With property as collateral, lenders are more willing to extend higher loan amounts, giving borrowers access to substantial funds.

-

Longer repayment tenure: LAP typically comes with longer repayment tenures, easing the burden of monthly repayments and providing flexibility in managing finances.

-

Versatile usage: Borrowers have the flexibility to utilize LAP funds for various purposes, from funding business expansions to covering personal expenses or even purchasing another property.

Finding the Lowest Interest Rates

Now, let's get to the crux of the matter - finding the lowest interest rates for loans against property. Interest rates for LAP can vary among lenders and depend on factors such as the borrower's creditworthiness, loan amount, property value, and prevailing market conditions. Here's how you can go about discovering the lowest interest rates:

-

Research and Compare: Start by researching various lenders offering LAP and comparing their interest rates, processing fees, and other terms and conditions. Online comparison platforms can be incredibly helpful in this regard, allowing you to compare multiple offers side by side.

-

Check Credit Score: Your credit score plays a crucial role in determining the interest rate you'll be offered. A higher credit score typically translates to lower interest rates. Make sure to check your credit score and take steps to improve it if necessary before applying for a LAP.

-

Negotiate with Lenders: Don't hesitate to negotiate with lenders to secure the best possible interest rate. If you have a good credit history and a strong financial profile, you may be able to negotiate a lower rate.

-

Consider Loan-to-Value Ratio: The loan-to-value ratio, which represents the percentage of the property's value that the lender is willing to finance, can impact the interest rate. A lower LTV ratio may result in a lower interest rate.

Example Scenario:

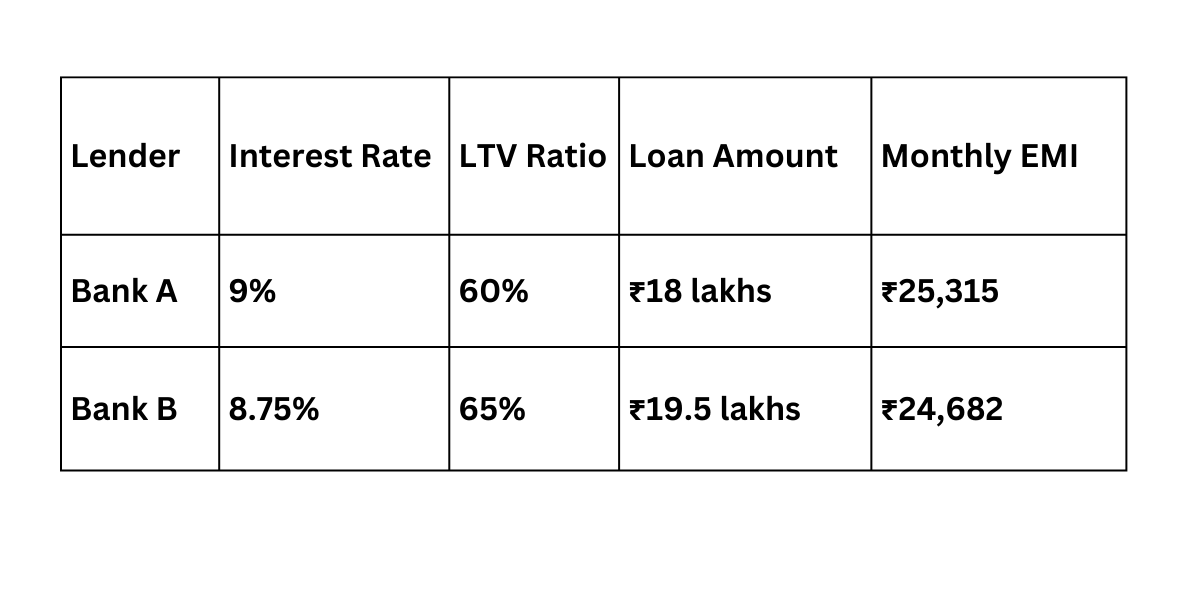

Let's consider an example to illustrate how interest rates can affect the overall cost of a loan against property.

-

Mr. Sharma wants to renovate his house and needs ₹30 lakhs for the project.

-

He approaches two different lenders for a LAP, Bank A and Bank B.

-

Bank A offers an interest rate of 9% with an LTV ratio of 60%.

-

Bank B offers a slightly lower interest rate of 8.75% but with a higher LTV ratio of 65%.

Comparison Table:

In this example, even though Bank B offers a slightly lower interest rate, the higher LTV ratio results in a lower loan amount compared to Bank A.

Conclusion

Loan against property can be an excellent option for accessing funds at lower interest rates, but it's essential to research, compare, and negotiate to secure the best deal. By understanding how interest rates are determined and considering factors such as credit score and loan-to-value ratio, you can unlock capital efficiently and achieve your financial goals with ease. Whether you need funds for a personal project or business expansion, exploring LAP options could be the key to realizing your ambitions.

So, don't let your property sit idle when it can help you achieve your dreams. Explore the possibilities of a loan against property and discover the lowest interest rates available in the market. Unlock the capital you need and take strides towards a brighter financial future.