When you first hear the term "Economics," what comes to mind? Graphs, supply and demand, or complicated math. But at its core, IB Economics isn't really about money; it’s about choices.

Every single day, your life is a series of decisions—from what to study for, to which career path to pursue, to how you spend your Saturday. Economics offers a powerful framework for making those decisions smarter, more efficient, and ultimately, more fulfilling. It’s a curriculum that trains you to think, not just to calculate.

Thinking in Trade-offs: The Power of Opportunity Cost

Imagine you have two job offers: one that pays slightly more but requires a longer commute, and one that pays less but offers better work-life balance. Which do you choose?

Economics introduces the concept of Opportunity Cost—the value of the next best alternative that you give up when you make a choice.

In life, this is gold. If you choose to binge-watch a show, your opportunity cost is the time you could have spent studying for an exam or learning a new skill. If a company decides to invest in a new product line, its opportunity cost is the profit it could have made from upgrading an existing one.

Understanding trade-offs forces you to weigh your options honestly, asking: "What am I really giving up for this benefit?" This simple mindset shift is key to better personal and career choices, whether you’re picking a university major or deciding where to allocate your energy.

Understanding the Bigger Picture: Systems and Incentives

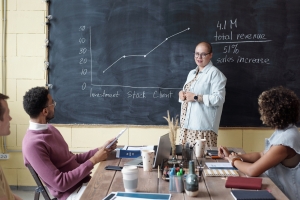

One of the most valuable lessons in IB Economics is learning how the world works as a system. You don’t just memorize definitions; you know about the relationships between governments, businesses, and consumers.

You learn that people and organizations respond predictably to Incentives. Why do companies offer loyalty programs? Why do governments tax certain products?

This macro-level thinking is invaluable for future leaders and entrepreneurs. It gives you the ability to zoom out and ask:

- "If I start this business, how will my competitors react?"

- "If our government changes this law, how will it affect consumer spending?"

You move beyond isolated problem-solving to understanding how one action creates ripple effects across an entire market or society. Through targeted support from experienced online tutors, students learn to connect theory with real-world problem-solving.

Rationality vs. Empathy: A Balanced Approach

Traditional economics often assumes we are all "rational economic agents," perfectly logical in our decisions. But IB Economics, particularly when exploring behavioral economics, acknowledges the messy reality of human behavior—our biases, our emotions, and our desire for fairness.

This is where the discipline balances logic with ethics.

As a student, you're not just solving a utility maximization problem; you're debating whether pursuing pure profit at the expense of environmental sustainability is the 'right' decision. This insight is crucial for students transitioning into adulthood: it teaches you to use the analytical tools of economics to solve problems, while never losing sight of the ethical and social consequences. It makes for not just better thinkers, but better citizens.

Building Financial Awareness: Smart Habits Start Now

Let’s be honest: most of us weren’t taught how to manage a budget or understand compound interest in high school. IB Economics concepts—like demand elasticity, investment, and inflation—provide a fundamental toolkit.

By understanding how inflation erodes purchasing power or how interest rates affect loan repayments, young learners are equipped to become financially responsible adults. They learn the vocabulary of the financial world before they’re overwhelmed by credit card offers or mortgage applications. It’s an investment in their future economic health.

Resourcefulness and Adaptability: The Essential Art of the Pivot

If there's one word that defines a successful startup, it's "pivot." It’s the ability to take limited resources—time, budget, personnel—and quickly change course when the initial plan hits a roadblock. And this skill, I’ve noticed, is constantly being honed by students tackling the sheer volume of IB coursework.

Think about the crunch period before deadlines. You’re working on three IAs, revising for two HL exams, and the CAS project you planned runs into a scheduling nightmare. You can’t just stop; you have to find a workaround. That’s pure resourcefulness.

I remember 'Javier,' a dedicated DP student who was determined to use primary survey data for his Geography IA on urban planning. He spent two entire weekends trying to get responses from local businesses, but they just weren't engaging. He was burning time and getting frustrated. A traditional academic might just give up, but Javier, unknowingly, engaged his startup brain.

Instead of abandoning the topic, we discussed a pivot. He couldn't get the quantity of original data he wanted, so he shifted his focus. He used the few responses he did get as qualitative case studies, supplementing them with readily available, high-quality, government-published census data. He turned a failed data collection effort into a sophisticated mixed-methods approach. He adapted, salvaged the time he had invested, and delivered a thoughtful analysis. He learned that successful people—in business and in the IB—don't always get it right the first time, but they are masters at quickly adjusting their sails. That ability to be resourceful under pressure, using what you have to achieve your goal, is perhaps the most valuable entrepreneurial lesson the IB teaches.

Conclusion: Economic Thinking as a Life Skill

IB Economics is more than just a prerequisite for a business degree; it is a life skill. It provides the lens through which you can analyze any situation—personal, professional, or political—and make a more informed, intelligent choice.

It trains you to:

- Acknowledge and quantify the trade-offs you face.

- Analyze the incentives driving people and systems.

- Balance logic with a recognition of human and ethical factors.

In a world full of complex challenges, economic thinking is the compass that guides us toward smarter, fairer choices, ensuring that our resources—our time, our money, and our energy—are allocated to build the best possible lives for ourselves and our communities.